Help Preserve Your Retirement Assets and Leave a Legacy

Our retired millionaire clients want to help preserve their wealth, reduce taxes and leave a legacy to their family

after they’re gone. You’ve worked hard to build what you have, and now that you’re retired you want

retirement strategies that allow you to feel in control of your money and financial future in retirement.

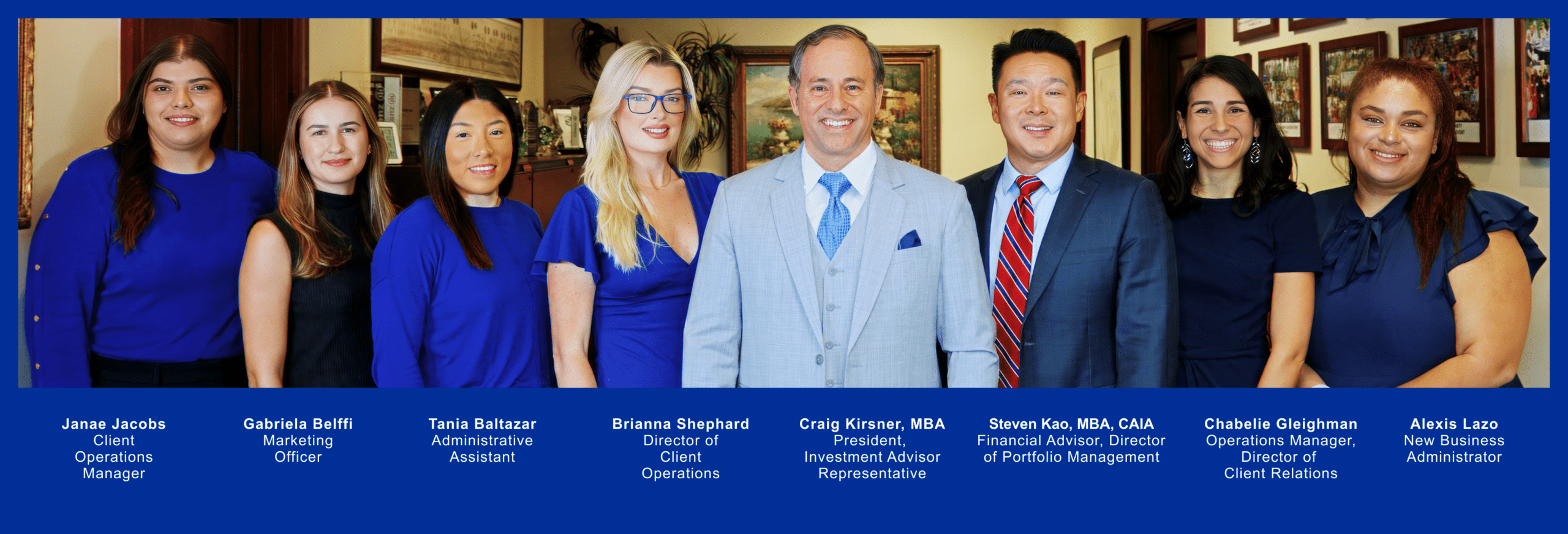

FOUNDED IN 1972

Craig Kirsner has been seen on:

Any media logos &/or trademarks contained herein are the property of their respective owners & no endorsement by those owners of Craig Kirsner or Kirsner Wealth Management is stated or implied. The appearances in Kiplinger and Forbes were obtained through a PR program. A PR firm was paid to assist with media placement.

Craig Kirsner, MBA is a Forbes Magazine #179 Top Financial Security Professional in the Entire United States for 2021 and a Forbes Top Financial Security Professional in the entire State of Florida for 2022 to 2025.

Forbes Top Financial Security Professionals 2025 is a ranking of financial professionals conducted by Forbes through the SHOOK evaluation process. To be considered by Forbes, Craig Kirsner was nominated by an insurance carrier he sells annuities through. Financial Security Professional (FSP) refers to professionals who are properly licensed to sell life insurance & annuities. FSP may also hold other credentials & licenses which would allow them to offer investments and securities products through those licenses. References to security refer only to the benefits of insurance products, not to investments. Insurance products are backed by the financial strength & claims paying ability of the issuing carrier. For more information on the FSP Ranking visit this link: https://www.forbes.com/sites/rjshook/2025/07/10/methodology-americas-top-financial-security-professionals-2025/ and https://www.forbes.com/best-in-state-financial-security-professionals/.

Kirsner Wealth Management has a strategic partnership with tax professionals and attorneys who can provide tax and/or legal advice. Neither Kirsner Wealth Management or its representatives may give legal or tax advice. You are encouraged to consult your tax advisor or attorney.

Learn Strategies to feel in Control of your Money and Financial Future In Retirement at one of our upcoming dinner workshops at Ruth’s Chris Steakhouse or Abe & Louie’s steakhouse:

- Hear from guest speaker Jack Owen, Jr. Esquire, Estate Planning Attorney & CPA about ways to create an Estate Plan designed to help protect the assets you leave to your Children and grandchildren from potential future divorces, lawsuits and creditor claims, and help ensure your assets stay in your family bloodline

- Taxes are potentially going up in 2026, are you concerned?! If so, what strategies should you look into now?

- Learn strategies to help protect your retirement assets from the next Recession – what should you do NOW to prepare?

- The high costs of many mutual funds and variable annuities – what are you really paying in fees each year?

- Now that your children cannot do a Stretch IRA, how might that affect your current planning?

- How much risk do you want in your Retirement Portfolio? How much risk do you actually have? NOW is the best time to get a second opinion on your retirement plan

- How can you adapt to today’s volatile economy, tax laws and evolving investment world? Are you truly diversified, or do you just think you are?

- Learn IRA tax strategies that could potentially help save you income taxes

- Strategies designed to help preserve your retirement assets

- Alternatives for today’s low-rate CDs and money market funds to help combat inflation

Attend a Dinner Workshop:

Ruth's Chris Steak House

Abe & Louie's

Are you over age 60 with $1 million to $10 million or more in net worth?

If so, attend one of our upcoming Dynasty Estate Planning and Retirement Planning dinner workshops to learn Ways to Help Preserve Your Retirement Assets and Leave A Legacy

Call us at 1-800-807-5558 to register for a workshop now!

This event is not sponsored nor endorsed by Ruth’s Chris Steak House.

The views, information, or opinions expressed during these events are solely those of the presenter(s) and do not necessarily represent those of Ruth’s Chris Steak House and its employees.

Are you getting concerned about

Stock Market Volatility and a Potential Recession?

Please note, it is not possible to invest directly into the S&P 500® Index; this measure is provided solely as a gauge of overall market performance. Standard & Poor’s: “Standard & Poor’s®,” “S&P®,” and “S&P 500®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The historical performance of the S&P 500 is not intended as an indication of its future performance and is not guaranteed. This chart is not intended to provide investment, tax or legal advice. Be sure to consult a qualified professional about your individual situation. This chart does not take into account investment fees, so actual results may be different than depicted above. The down percentages shown above are from the top of the market to the bottom of the market in each down move without dividends. The up percentage is from March 9th, 2009 through June 30th, 2025 without dividends. Source: https://www.barchart.com/stocks/quotes/$SPX/interactive-chart.

Learn Strategies to feel in Control of your

Money and Financial Future In Retirement

We've seen this movie before: Sky-high real estate prices, sky-high stock market prices and we have our own ideas on how this movie is going to end, we just don't know when. Some retirees may be concerned about going through another 2008 type of crash again and might be looking for strategies designed to help minimize their risk, help preserve their wealth and leave a legacy to their family.

We may help you come up with a strategy that is designed to help:

- Address the level of risk in your retirement plan and may help to lower that risk while using financial tools to generate retirement income.

- Provide diversification with potentially lower fees

Fun Quarterly Client Events for Kirsner Wealth Management Clients:

Call 1-800-807-5558 to attend a dinner workshop at Ruth's Chris or

Abe & Louie's Steakhouse in Boca Raton or Fort Lauderdale, Florida

Help Preserve Your Retirement Assets and Leave a Legacy

Our retired millionaire clients want to help preserve their wealth, reduce taxes and leave a legacy to their family after they’re gone. You’ve worked hard to build what you have, and now that you’re retired you want retirement strategies that allow you to feel in control of your money and financial future in retirement.

FOUNDED IN 1972

Contact us at [email protected] or call us at 1-800-807-5558 to come to an upcoming dinner workshop at Abe & Louie’s or Ruth’s Chris Steakhouse or to schedule a time to discuss your financial situation.

https://www.investopedia.com/taxes/how-gop-tax-bill-affects-you. Jack Owen, Jr. Esquire CPA is not affiliated with Kirsner Wealth Management or AEWM.